The Best Dividend ETFs for 2023

Disclaimer: I am not a certified financial advisor. Do your own research and if necessary consult a professional investment advisor before making any investment decisions!

Despite high inflation in 2022, dividend-oriented ETFs can still be a good form of investment to save & invest your money. In this article, we want to take a closer look at some of the best ETFs in this sector.

Schwab U.S. Dividend Equity ETF (SCHD)

SCHD fund is a well known and popular ETF with over $35 billion in AUM (assets under management). According to Schwab the fund’s goal is to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100™ Index.

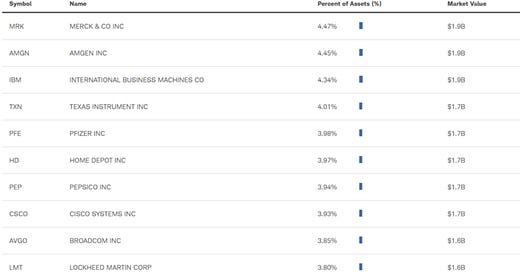

As of November 2022 the fund includes over 100 different securities; the fund aims to invest in stocks selected for fundamental strength relative to their peers, based on financial ratios. The biggest positions currently are MERCK and AMGEN followed by companies that also have a strong dividend record.

As you can see on the following list no position within the fund has a larger share than 5% of the total portfolio. It is also a very low cost fund with annual fees of just 0.06% which is another big bonus of this ETF and a current dividend yield of around 3.4 %.

It is important to mention that the fund due to its strategy, which has a bias toward more generous payers instead of simply the largest stocks, it also has a very good overall performance as the following price chart demonstrates:

Despite the COVID crash of 2020, SCHD has managed to be a great ETF so far and will likely continue to outperform most of its competitors in the years to come.

Vanguard Dividend Appreciation ETF (VIG)

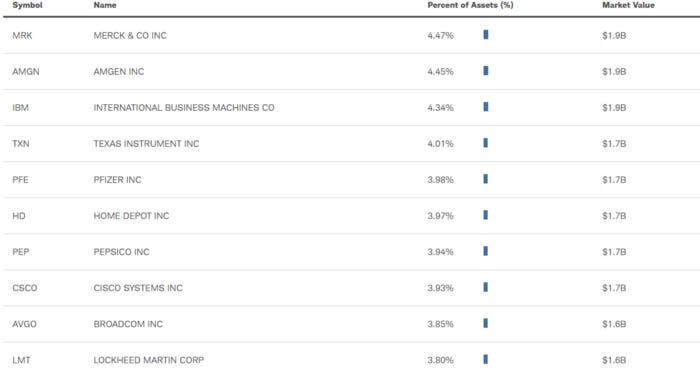

VIG is currently the largest dividend ETF with almost 60 billion US $ in assets under management. It seeks to track the performance of the S&P U.S. Dividend Growers Index. The fund focuses on large-cap assets , emphasizing stocks with a record of growing their dividends year over year.

Just like SCHD it is also low cost at just 0.06% annual fees. The dividend yield with around 2 % p.a. is lower than those of other ETFs in part however the overall yield (dividend plus growth) is still pretty good for long term investors

Vanguard Real Estate ETF (VNQ)

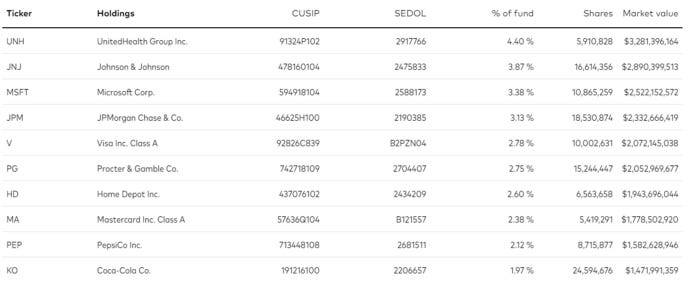

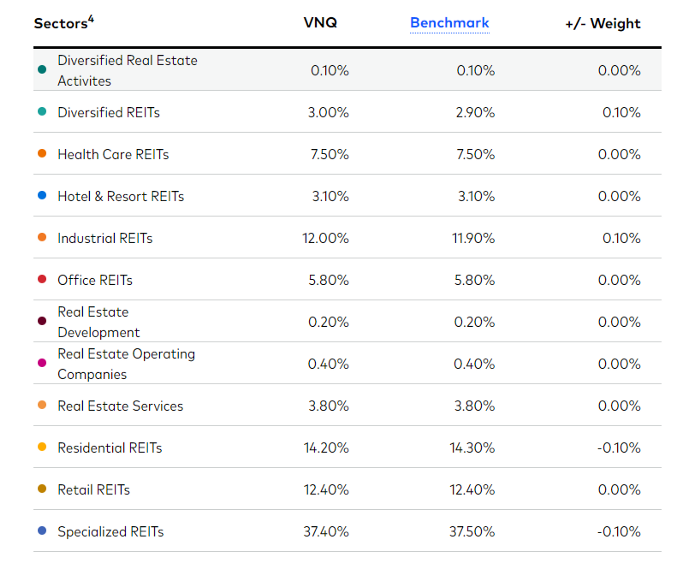

This Vanguard fund, with over $33 billion in total assets and about 170 securities, is the largest real estate ETF on Wall Street. VNQ is entirely made up of REITs (real estate investment trusts), which are a type of organization that must return 90% of its earnings to shareholders in exchange for favourable tax treatment. Its goal is to closely track the return of the MSCI US Investable Market Real Estate 25/50 Index.

The composition of the fund is also very diversified. Currently it is invested in the following areas:

With a dividend yield of about 3.7% p.a. at an annual cost of only 0.12 % in fees, its well-diversified, market-cap-weighted portfolio will be difficult to beat over the long term.